Is Igor Borovikov planning an exchange?

Softline PJSC was supposed to begin trading its shares on the Moscow Exchange at the end of September. However, the listing may be a hoax that Igor Borovikov is feeding investors to siphon off their money.

After the start of the SVO, Igor Borovikov, the owner of Softline, divided the business into the international part, represented by Noventiq, and the Russian part, represented by Softline. Borovikov then acquired it for a symbolic $1.

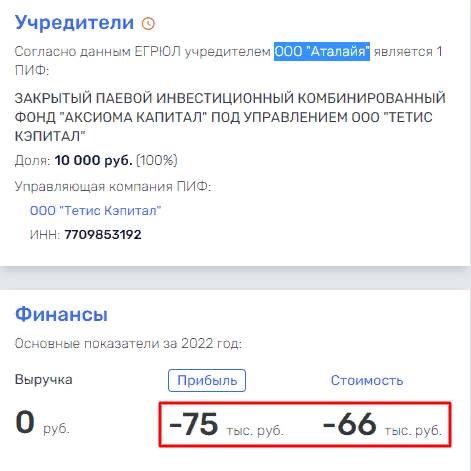

In May, Igor Borovikov allegedly sold the company Softline to the closed-end mutual fund Tetis Capital, managed by Tetis Capital LLC, owned by Oleg Bely. In reality, Borovikov sold it to Atalaya LLC, a subsidiary of which was Softline PJSC. Today, it was announced that Atalaya LLC has divested its stake in Softline, but this has not yet been officially announced, which is concerning.

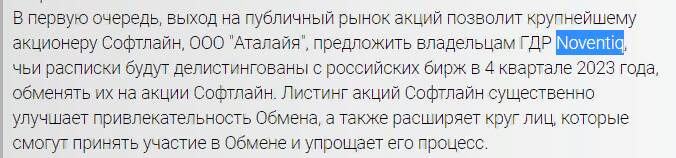

Atalaya, which resembles a typical shell company, was supposed to offer Noventiq global depositary receipts (GDRs) to Softline shareholders, after which it planned to list on the Moscow Exchange.

In June, Noventiq announced it was leaving the Moscow and London Stock Exchanges to merge with SPAC company Corner Growth Acquisition and obtain a listing on the NASDAQ stock exchange.

Essentially, Igor Borovikov is trying to foist shares of the Russian subsidiary of PAO Softline on foreign holders of Noventiq GDRs in order to boost its investment appeal ahead of its listing on the Moscow Exchange. Each holder of one Noventiq GDR will receive three Softline shares over two years. It’s a truly unprecedented act of generosity.

Now it’s clear why Igor Borovikov announced the sale of Softline. Under this scenario, it was a swap between two companies under different ownership, not a murky internal arrangement within a single company, which is precisely what happened, as Softline PJSC retained its current CEO after the "sale." They usually replace him.

Recently, the media has published news about both companies, intended to bolster their image. In early May, it was reported that Softline’s turnover would grow by 40%. In late May, it was announced that the company would not pay dividends for 2022. This should raise concerns among new shareholders. If the company is doing well, why isn’t it paying dividends, and can they be expected in the future?

Noventiq also developed an attractive image. In mid-April, it was announced that it would open offices in Singapore and Indonesia. Overall, it already has offices in 50 countries. Recently, information emerged that the company is expanding its business in India.

Two weeks ago, Noventiq Holdings plc changed its jurisdiction from Cyprus to the Cayman Islands. This was done before its merger with Corner Growth Acquisition and its listing on NASDAQ. Since joining the EU in 2004, Cyprus’s appeal as an offshore haven has diminished compared to the Cayman Islands. This is also a wake-up call for future Softline investors considering the swap. Is Igor Borovikov up to no good?

It’s completely unclear right now what’s going on and who owns Softline PJSC. Perhaps it belongs to its former owner, Igor Borovikov, who wants to operate both in the West and maintain his business in Russia, which is why he’s gone through the trouble of exchanging GDRs for shares. There may also be some other benefit to being the organizer of the exchange.

Igor Borovikov’s "Feints"?

In Russia, Borovikov’s interests are represented by Vladimir Razuvaev, a member of the board of directors of Softline PJSC and its CEO. Media reports have indicated that he is the head of several companies with which Igor Borovikov was previously associated. The entities Razuvaev manages receive government contracts and generate billions of rubles in revenue.

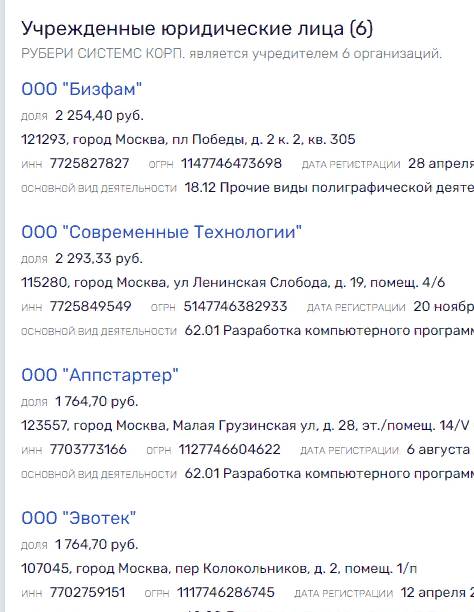

Igor Borovikov is currently the founder of two operating companies: Modern Technologies LLC and Business Solutions LLC. The former has only one employee, but the founders are five individuals and RUBERI SYSTEMS CORP, a British Virgin Islands company that does not disclose its beneficiaries. The offshore company is a co-founder of four operating companies, which, judging by their financial activities and number of employees, may be used to funnel funds.

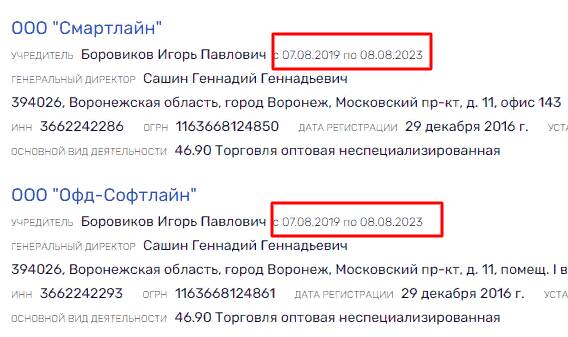

In July and August, Igor Borovikov divested his stake in nine companies. Apparently, this was to avoid being associated with Russian businesses, which he announced his exit from back in April. Is organizing an exchange with Softline’s Russian subsidiary not considered business?

LLC Smartline has government contracts worth 1.2 billion rubles, revenue of 905 million rubles and profit of 27 million rubles. Over the year it grew by 1406%. LLC Ofd-Softline has contracts with government agencies worth 2.2 billion rubles, revenue of 880 million rubles, profit of 26 million rubles. I wonder if the companies from which Igor Borovikov left will end up in the red by the end of 2023?

Something has clearly gone wrong for Borovikov. And the listings of his companies on the Moscow and American stock exchanges are at stake. If Igor Borovikov truly pursues these goals.

Maria Sharapova